At Treads, we’re all about simplifying your life and bringing value. Our partnership with Grow Credit does exactly that and fits seamlessly with our service. Read on to learn how you can use Grow Credit to pay your subscriptions and build credit.

How Treads and Grow Work Together

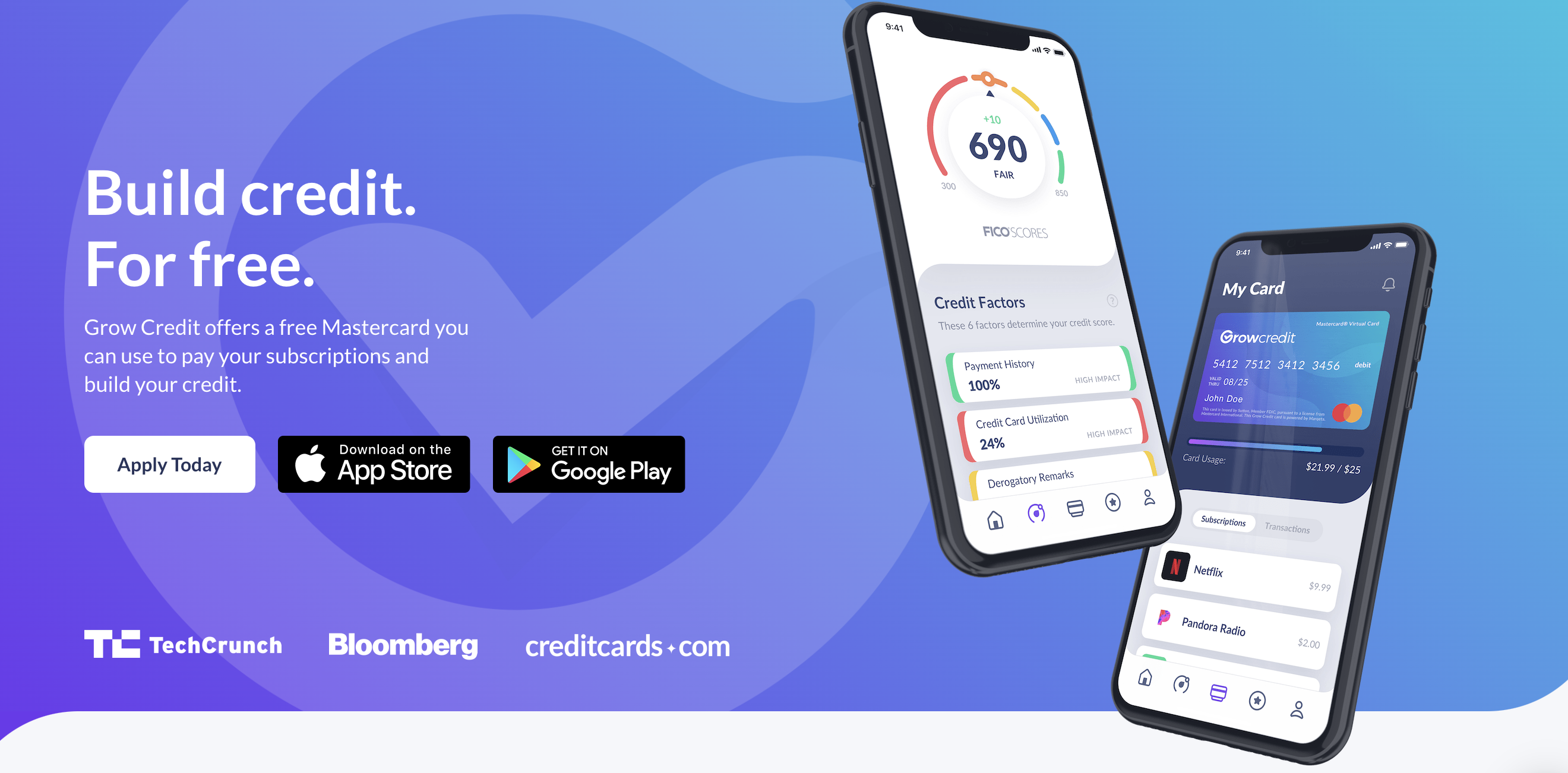

Grow Credit is a simple way for individuals with limited credit options to improve their financial standing. After signing up for the service, users can add various streaming and subscription services to their Grow account.

Every month, the account is paid in full and customers build a positive payment history.

Treads fits seamlessly into your Grow subscription service. Just link both accounts together through both companies’ apps and pay with your Grow credit card.

Once you do, you’ll get all the benefits of Treads while working toward an improved credit score.

The Top 3 Benefits of Using Treads and Grow

The Treads and Grow partnership provides some exciting benefits for customers. Thanks to this program, you’ll drive confidently knowing that a flat tire won’t be a financial hurdle while looking forward to a better financial future.

1. Improve Credit Score

The ability to improve your credit score is the most important benefit of the Treads and Grow partnership. Keep making payments on time and you’ll see your credit steadily get better. A little bit of patience is required, but your persistence will pay off in the end.

The Importance of Credit

Over 108 million Americans have a low credit rating or no credit at all. This can be a huge challenge to overcome, as this score affects your ability to secure a loan, get a mortgage, and open a credit card account. Some jobs even require a credit check and won’t consider applicants with a poor credit rating.

With a low credit score, you’ll have to pay more money in interest rates if you are approved for a loan. These rates can be crippling and make it difficult for someone with a low credit rating to improve their living situation. For example, a new car loan will cost a low-credit applicant thousands of dollars more than someone with a higher credit score.

While your score is incredibly important, you have the power to take control of it. Work with Treads and Grow to improve your credit, manage your finances responsibly, and always make your payments on time.

2. Finance New Tires

For many Americans, cars are a necessity. You need a car to run errands, visit family, and, most importantly, make it to work on time.

So, if you wake up one morning and notice you have a flat tire, you’re forced to take the time to deal with it. Not only will you have to pay to replace the tire, but you’ll also have to take time out of your workday. With so many Americans already living paycheck-to-paycheck, this represents a sizable financial hit.

Thanks to the Treads and Grow program, paying for new tires won’t be such a financial burden. You’ll be able to finance the tires and get rolling again without the headache.

3. The Convenience Factor

Finding car repairs when you need them can be a challenge. You need to trust the expertise of whoever is working on your car. However, a flat tire needs to be fixed right away, so you likely won’t have time to track down the best possible solution.

The Treads and Grow partnership makes it easy to receive tire services on the spot when you need them. No more taking off work to sit in a dingy waiting area, and no more Googling “what to do” when you get a flat.

You’ll also reap the benefits of at-home service. With Treads, a certified tire installer will come to your home and supply you with whatever tire service you need.

Getting Started with Treads and Grow

To get in on all the benefits offered by the Treads and Grow partnership, you’ll need to sign up for both services.

Signing up for Treads is simple. You’ll just download the app and pick your preferred plan. A new set of tires could be yours for as little as $30 per month.

Joining the Grow program has a few more steps but is still quite easy. Like at most credit institutions, you’ll have to start by submitting an application.

The good news is that Grow only performs what’s known as a “soft” credit check on new applicants. This is done solely to identify you and won’t appear on your credit report. Once accepted, they’ll send you a Grow credit card that you’ll use to manage your online subscriptions.

A lot of other credit institutions perform a “hard” credit check, which does appear on your credit report and can lower your credit score.

Now that both accounts are up and running, you’ll need to link your accounts together. On the Grow app, add Treads to your subscriptions. Then head over to the Treads app and add your Grow credit card as your payment method.

Now you’re all set. You’ll never have to worry about another flat tire and can start building your credit.

Treads and Grow Subscription Services

On their own, Treads and Grow are both incredible subscription services. Each provides an incredible value for its customers.

Thanks to their new partnership, you’ll be able to improve your credit score, have the option to finance new tires in an emergency, and get all your tire services performed in the most convenient way possible.

Ready to get started with Treads? Download the app from the App Store or Play Store today.